TNPSC Photo Compressor

Compress TNPSC photo to 20–40KB instantly. Perfect for online form uploads.

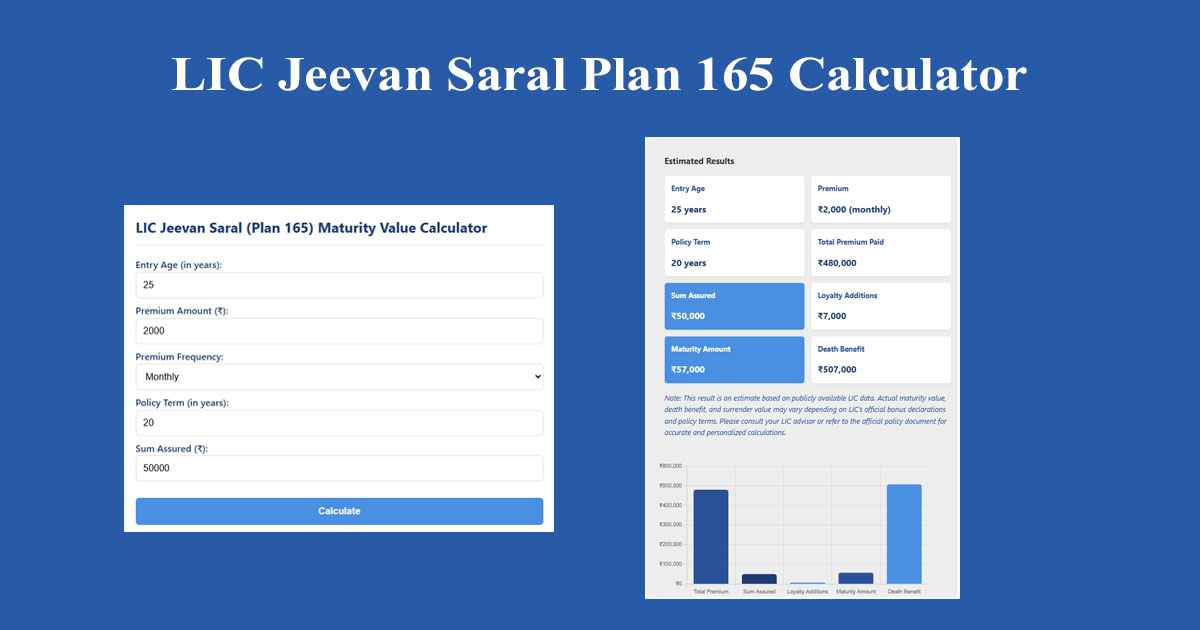

Estimate your maturity value, sum assured, loyalty additions & death benefits using LIC's Jeevan Saral (Plan 165) based on your premium and policy term.

Are you a policyholder or planning to invest in LIC’s trusted savings-cum-insurance product? Understanding your plan’s potential returns is key. The LIC Jeevan Saral Plan 165 Maturity Calculator helps you estimate your maturity amount, sum assured, loyalty additions, and death benefit using just a few basic inputs.

LIC’s Jeevan Saral (Plan No. 165) is a flexible, non-linked endowment plan offering a unique blend of protection and savings. This plan is especially popular among salaried individuals looking for liquidity, risk cover, and tax savings in a single product.

Manually calculating LIC maturity values can be tricky due to variable loyalty additions and age-based sum assured. Our online calculator for LIC Jeevan Saral Plan 165 eliminates the guesswork by estimating:

This tool is based on official LIC brochures and previous bonus trends. It is not an official LIC tool, but highly accurate for estimation.

Many users look for LIC Jeevan Saral Plan 165 Maturity Calculator Excel, but using spreadsheets can be time-consuming and error-prone. This web-based calculator is faster, more accurate, and optimized for mobile and desktop — no downloads required.

To get the most out of your LIC Jeevan Saral policy:

LIC Jeevan Saral (Plan 165) is a solid insurance cum investment product. If you're planning your savings or retirement corpus, using a LIC Jeevan Saral Maturity Calculator gives you clarity on your expected returns.

Start calculating your LIC Jeevan Saral maturity value today with our free online tool.

It gives a good estimate based on LIC bonus history, but for exact values, contact LIC or your insurance advisor.

The minimum monthly premium is ₹250, and it must be in multiples of ₹50.

The policy term can be between 10–35 years, and the maximum maturity age is 70 years.

Yes, the policy can be surrendered after paying premiums for at least 3 full years. You will receive the higher of Guaranteed Surrender Value or Special Surrender Value.

Loyalty additions are performance-based bonuses declared by LIC. They are applicable only if the policy has run for at least 10 years and is in force.

The maturity value is: Sum Assured + Loyalty Additions. The sum assured varies based on entry age, term, and premium amount.

Yes. Entry age is from 12 to 60 years. The plan matures by age 70.

Yes. Loans are allowed once the policy acquires a paid-up value, which typically happens after 3 years of continuous premium payment.

No, the maturity amount is exempt under Section 10(10D), provided the annual premium does not exceed 10% of the sum assured.

If premiums have been paid for at least 3 years, the policy becomes paid-up with reduced benefits. Otherwise, the policy lapses without value.

Yes. Optional riders like Accidental Death and Disability Benefit and Term Assurance Rider are available for added protection.